Not appointed with one of the carriers below

Click the button above to request a contract

Medicare Advantage Tools

To Access, these files Email is – [email protected]

To Access, these files password is: MEDICARE

Click on the file icon to Access Medicare Supplement Underwriting Documents.

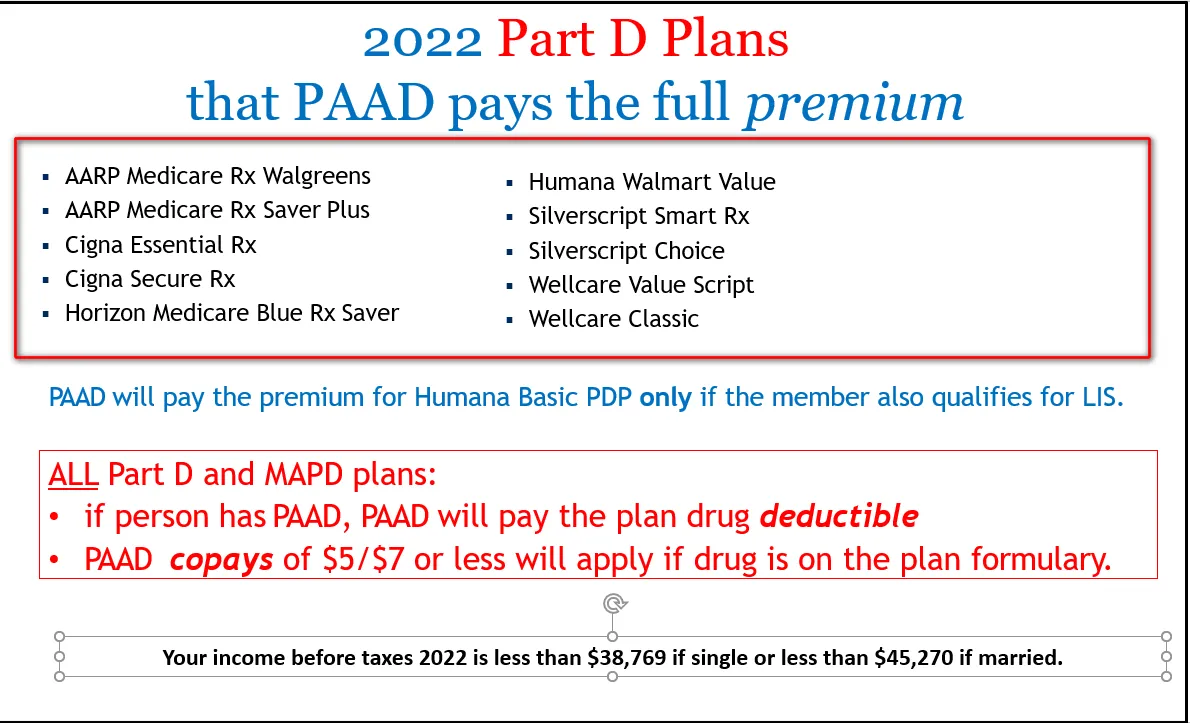

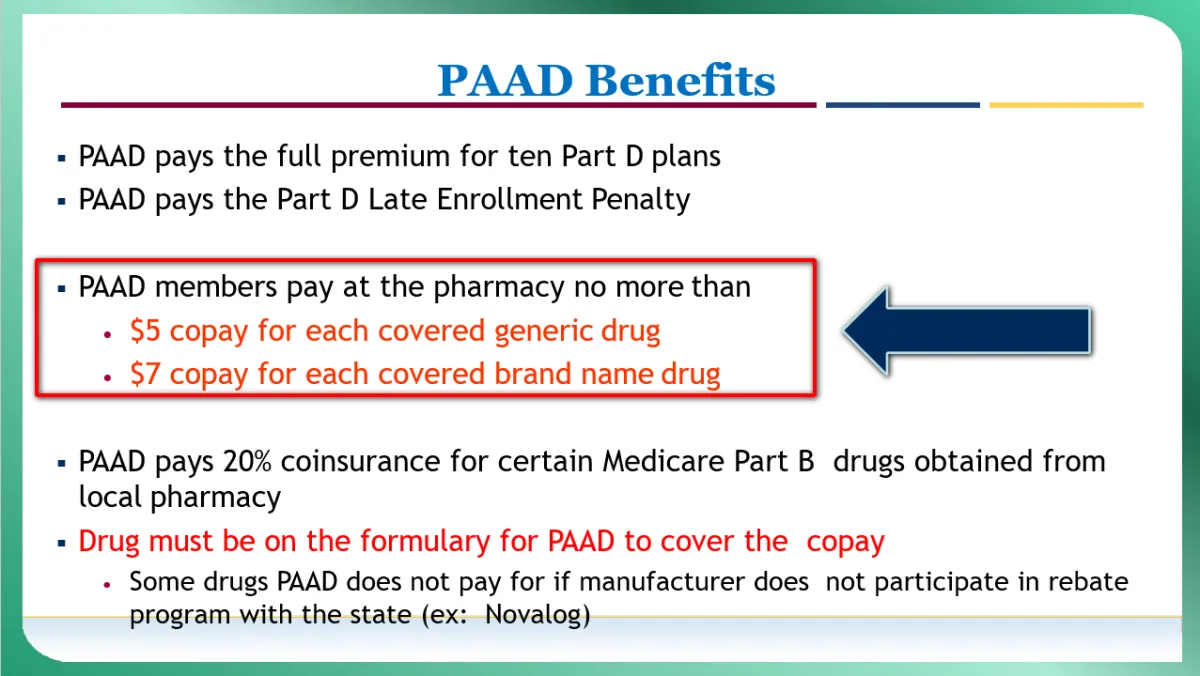

2026 PAAD LEVELS for New Jersey resident;

65 or older or between ages 18 and 64 and receiving Social Security Title II Disability benefits; and

Your income for 2025 is less than $53,446 if single or less than $60,690 if married.

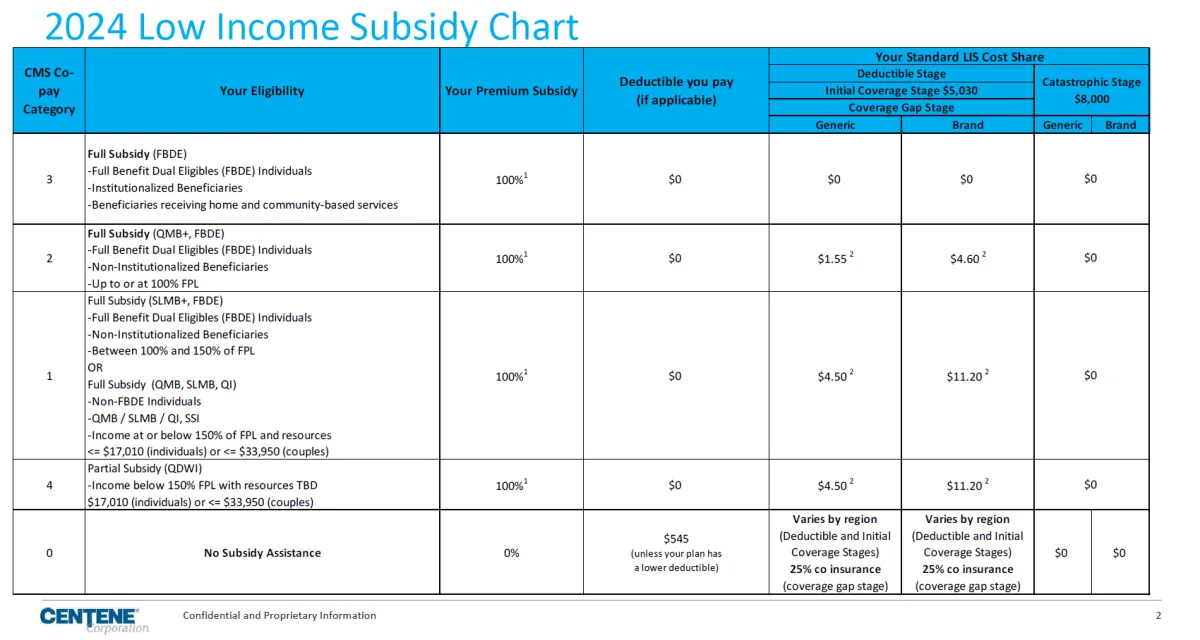

Dual & LIS Eligibility Status

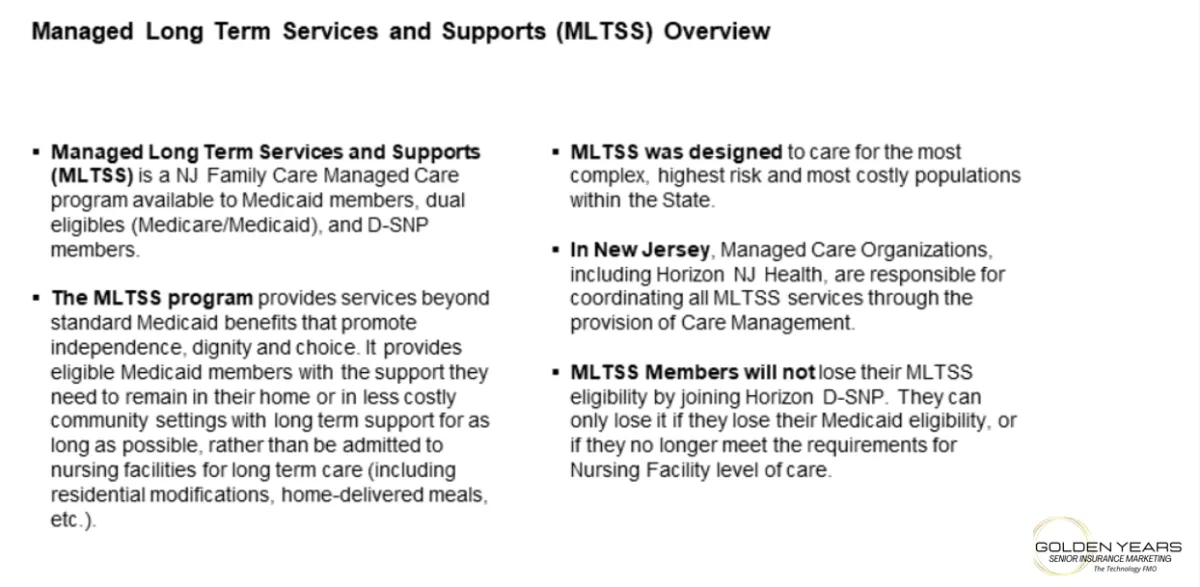

MLTSS

Covers home and community-based services for members who require the level of care typically provided in a nursing facility and allows them to receive necessary care in a residential or community setting. MLTSS services include (but are not limited to): assisted living services; cognitive, speech, occupational, and physical therapy; chore services; residential modifications (such as the installation of ramps or grab bars); vehicle modifications; social adult day care; and non-medical transportation. MLTSS is available to members who meet certain clinical and financial requirements.

It is important to verify that all of their providers are participating in our network including their preferred homehealth agency. The prospect may continue with an existing out-of-network provider during the transition period but must select an in-network provider following that time.

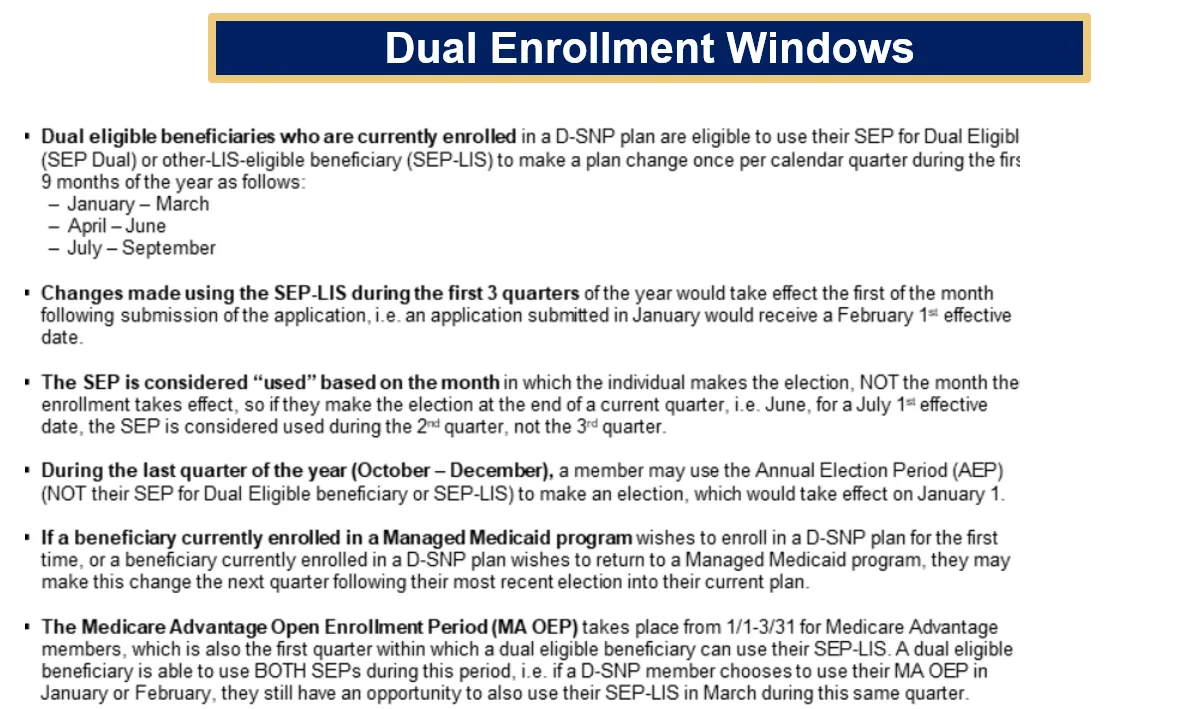

SEP:

Dual-Eligible & LIS and General SEP Reminders Attention Valued Partner, A Special Enrollment Period (SEP) is a period outside of the ICEP, AEP or MA OEP when beneficiaries can enroll, based solely on life events that cause an valid SEP.

Dual-Eligible & LIS Eligible Member 4th Quarter Reminders:

Dual-eligible and LIS beneficiaries that are not at-risk may use the SEP once per each of the first three calendar quarters only. This SEP may not be used in the 4th quarter of the year (October – December). In the 4th Quarter, AEP is the only valid enrollment period. Any plan changes/enrollments requested in the 4th quarter must be made during AEP and no later than December 7th. Please note that October 1 – October 15 and December 8 – December 31 there is no available LIS SEP. Beneficiaries will ONLY be able to follow the standard AEP timeframe for making plan changes during the 4th quarter (October 15 – December 7) and their effective date will be January 1, 2021.

General SEP Reminders:

Enrollment applications must be filled out correctly and completely, including any applicable SEP code. Don't forget to note an applicable SEP on electronic enrollments. For paper applications, be sure to note the applicable SEP on page 6. For emergency and disaster declarations, be sure to either select option 18 indicating a natural disaster OR option 19 and write “Severe Weather” – WARNING! Only select one election type

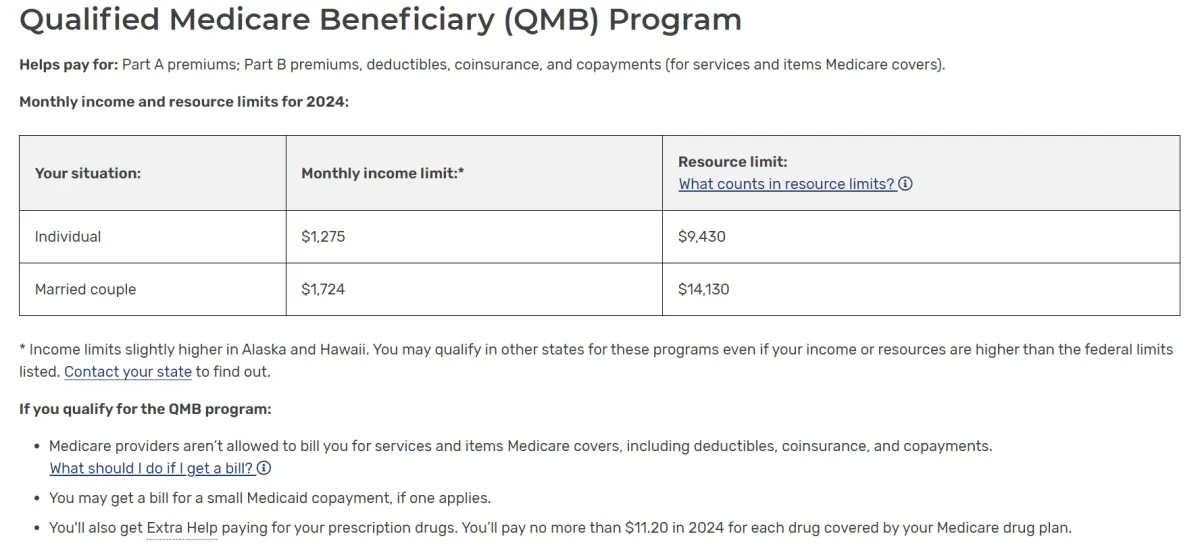

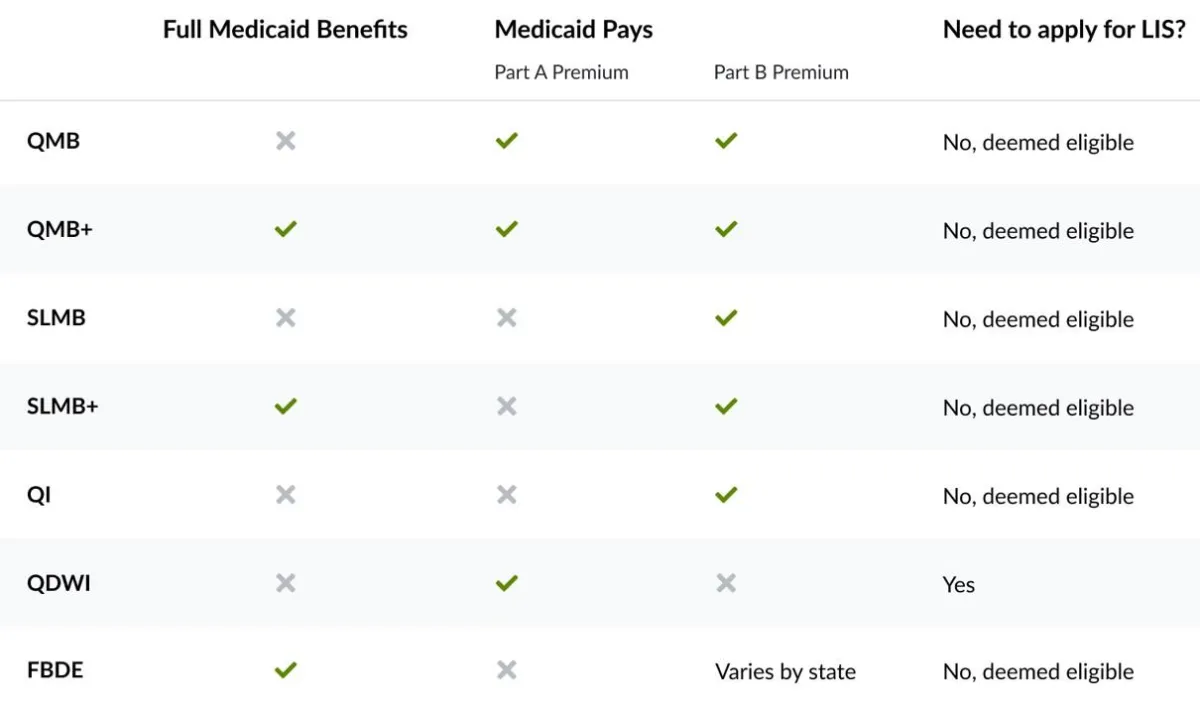

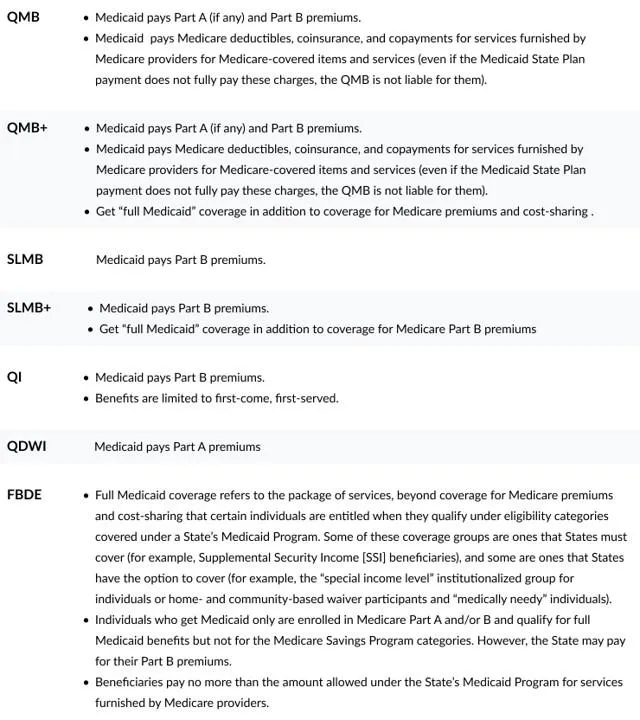

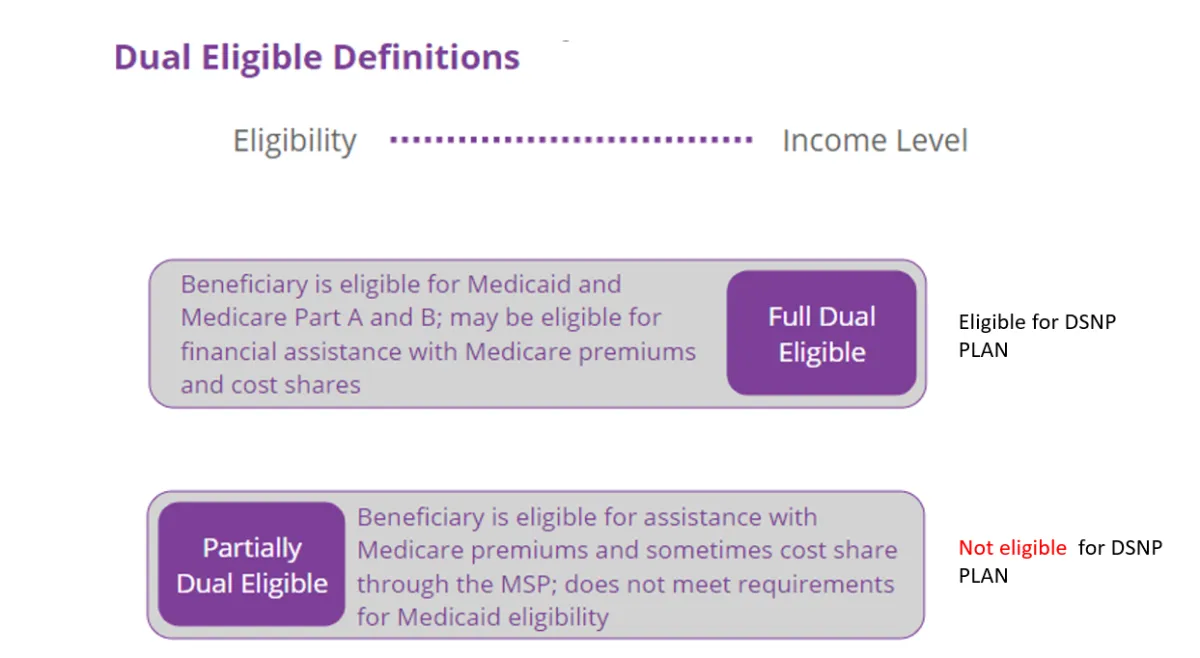

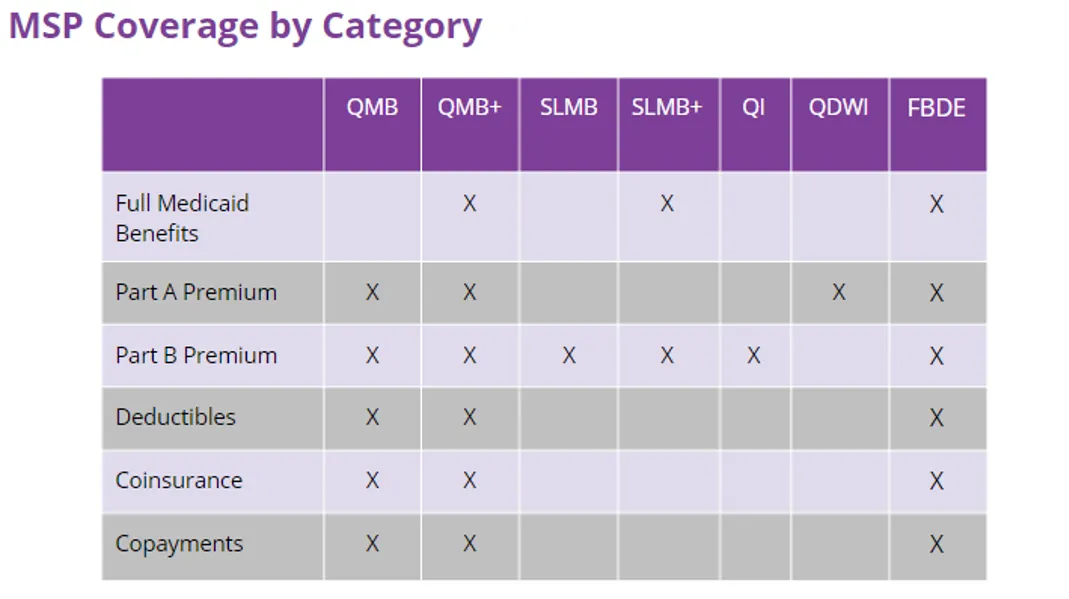

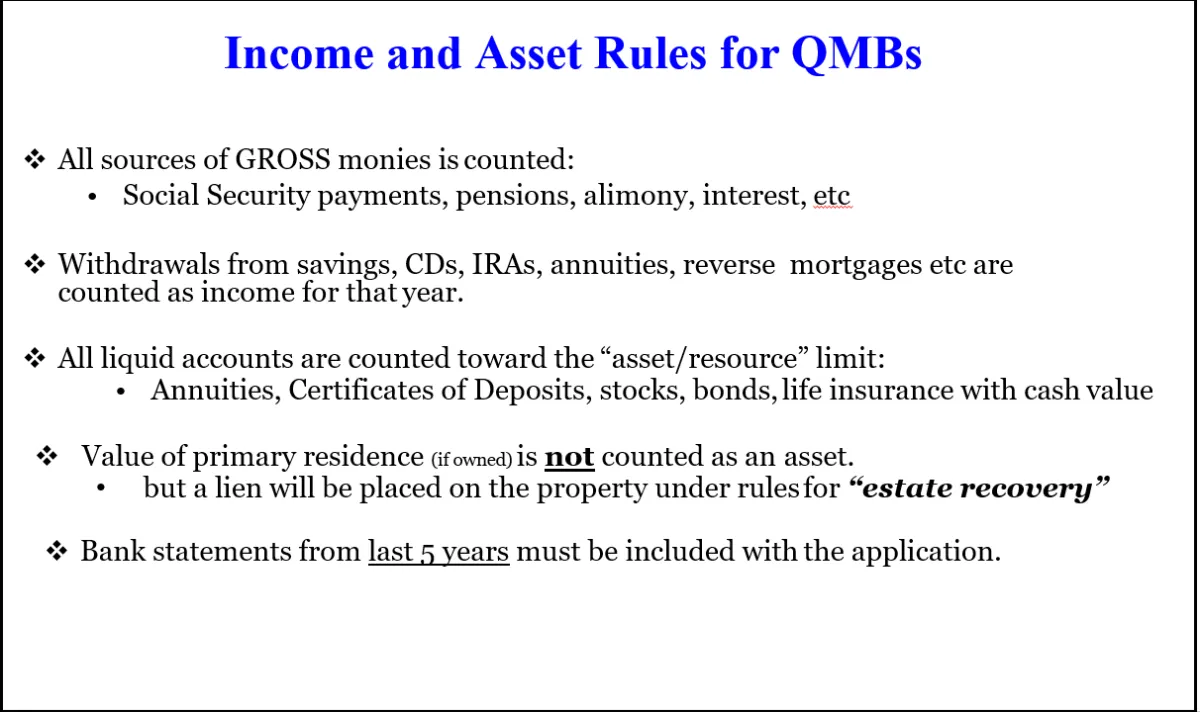

Dually Eligible Beneficiaries Under Medicaid and Medicare

4 kinds of Medicare Savings Programs

-Qualified Medicare Beneficiary (QMB) Program

-Specified Low-Income Medicare Beneficiary (SLMB) Program

-Qualifying Individual (QI) Program

-Qualified Disabled and Working Individuals (QDWI) Program

Go to Medicare.gov for full information:

https://www.medicare.gov/basics/costs/help/medicare-savings-programs

AGENTS SHOULD ALWAYS CHECK DSNP VERIFICATION TO MAKE SURE THE DSNP ACCEPTS THAT SPECIFIC LEVEL OF MEDICAID.

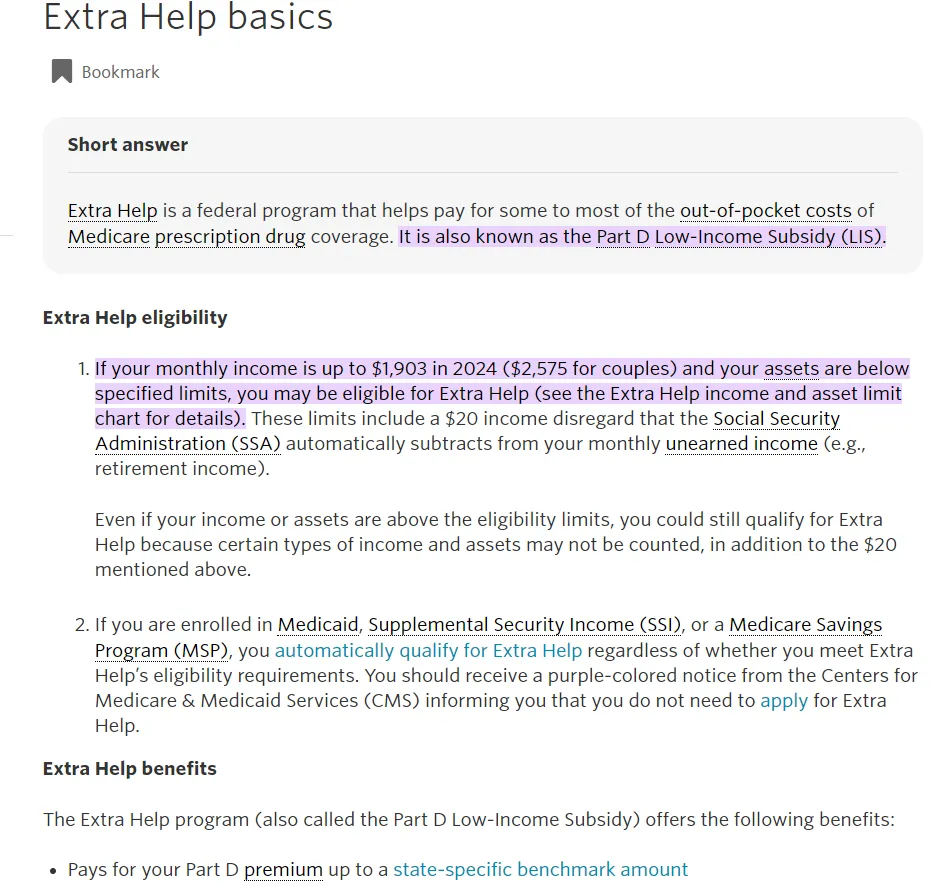

To apply for LIS beneficiaries can call SSA at 1-800-772-1213 or

apply online at https://secure.ssa.gov/i1020/start ⬅ (This link will take you to the SSA.gov Website.)

Look in the Evidence of Coverage to find which levels of Medicaid are accepted by the plan.

Use the shortcut "Control F" to search.

To check DSNP verification for Anthem https://mproducer.anthem.com/

call their DSNP verification line or by using Mproducer to confirm eligibility at

To check DSNP verification for Humana

you can log into Humana Vantage by going to www.humana.com and logging in.

Under quote and enroll click on Eligibility Verification.

To check DSNP verification for UHC https://www.uhcjarvis.com

you can log into Jarvis at and then click on the enrollment tab and find the Medicare and Medicaid Eligibility Lookup Tool.

Medicare AHIP 2023

Medicare AHIP for 2023 will be available on June 20th. The cost will remain $175 for the 2023 certification course and exam. The certification is $125 when taken through a number of the insurance company certification portals.

Completing the 2023 cert will certify you for the remainder of 2022. AHIP is not required for Medicare supplements. Most carriers (UHC/AARP is an exception) do not require certifications to sell their Medicare supplements.

Medicare AHIP $175 vs. $125 https://www.ahipmedicaretraining.com/page/login

Accessing AHIP through the AHIP Portal will cost $175. The certification (Medicare + Fraud, Waste and Abuse (MFWA)) will be available on June 20th 2023. We suggest waiting to take the course through one of the carrier training portals. There will be a need to wait a few days to access through the carrier but it will lower the price to $125.

MAPD Compliance Update 2022 May

Remember, it must be clear that you are not affiliated with or endorsed by the government or Medicare. A couple common ways to do this are listed below:

• “Not affiliated with or endorsed by the government or Federal Medicare Program."

• "<Agency name> is an insurance agency not affiliated with the government or Federal Medicare Program." or "Advertisement – Not affiliated with the government."

If material is asking for consumers to call/contact you, it needs to be clear who they are contacting (i.e. a licensed insurance/sales agent). You can list it as a disclaimer or work that language into other areas of the piece:

• “Calling the number above will direct you to a licensed insurance agent.”

• “To speak with a licensed insurance agent, call the number below!” or “Call now to speak with a licensed insurance agent about your Medicare options!”

Permission to contact:

if your marketing/advertising material (including website) is being used to gain permission to contact a consumer, it must include certain language. This language should include 1) who will contact them, 2) how they will contact them, and 3) what products will be marketed.

For example:

• “By providing the information above/below, I grant permission for licensed insurance agent, <agent/agency name>, to call me regarding my Medicare options including Medicare Supplement, Medicare Advantage, and Prescription Drug Plans.”

• “Please fill out the information below to have a licensed insurance agent contact you regarding Medicare Supplement, Medicare Advantage, and Prescription Drug Plans.”

If your material meets the definition of “marketing”, then these additional disclaimers apply:

Federal Contracting Statement Required on all "marketing" materials, except banners, banner-like ads, outdoor ads, text messages, social media, and envelopes.

Example Text:

“Plans are insured or covered by a Medicare Advantage organization with a Medicare contract and/or a Medicare-approved Part D sponsor. Enrollment in the plan depends on the plan’s contract renewal with Medicare.”

Third-Party Marketing Disclaimer Required on all third-party websites, marketing materials, and television/radio ads that meet the definition of "marketing". (Note: This disclaimer is not required for those that truly offer every option in a service area.)

Required Text:

"We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options."

Benefits Disclaimer If plan benefits are marketed (i.e. Dental, Vision, Hearing, OTC, Transportation, Fitness, etc.), the following disclaimer is needed:

Example Text:

"Not all plans offer all of these benefits. Availability of benefits and plans varies by carrier and location. Deductibles, copays and coinsurance may apply."

Third-Party Marketing Disclaimer:

Required on all third-party websites, marketing materials, and television/radio ads that meet the definition of "marketing". (Note: This disclaimer is not required for those that truly offer every option in a service area.)

Required Text: "We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options."

Benefits Disclaimer:

If plan benefits are marketed (i.e. Dental, Vision, Hearing, OTC, Transportation, Fitness, etc.), the following disclaimer is needed:

Example Text: "Not all plans offer all of these benefits. Availability of benefits and plans varies by carrier and location. Deductibles, copays and coinsurance may apply."

Part B Give-Back Disclaimer Required on all materials when Part B giveback info is included.

Required Text:

"Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction varies."

STAR Ratings Disclaimer If STAR Ratings are mentioned, you need to convey that plans are evaluated yearly by Medicare and that ratings are based on a 5-star rating system:

Example Text: "Every year, Medicare evaluates plans based on a 5-star rating system."

Quick Tips:

• Remember, any materials that meet the definition of “marketing”, must be submitted to CMS for review.

• So our advice is to keep it Generic! If you want to avoid CMS/Carrier reviews and disclaimers, refrain from using plan names, carrier logos, or plan specific information; as well as benefits, premiums, or cost-sharing information (even if in a general fashion). Just remember, including plan information (even in general) will require additional disclaimers (see table above), most likely submission to CMS.

• Focus your advertising on yourself or your agency rather than highlighting plan details. The more you talk about Medicare Advantage plans and the benefits they have, the more scrutiny they will receive, and most likely require submission to CMS and additional disclaimers.

• Put yourself in the shoes of a Medicare beneficiary. Is your language misleading or could it cause them confusion? Does your piece look “governmental” or like it came from Medicare? Are you using “high-pressure sales tactics” or language that could cause an undue sense of urgency or stress? If so, you should remove that language.

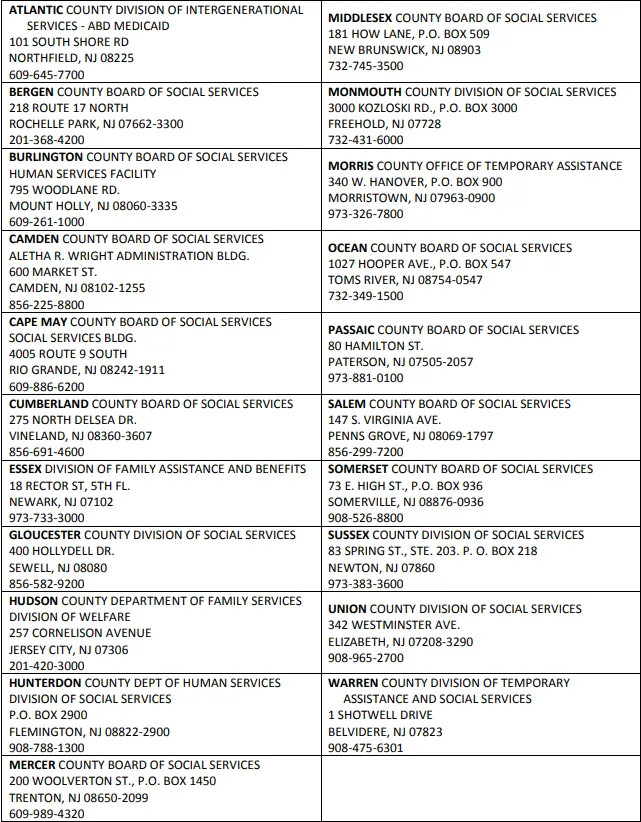

NJ Social Services Offices

Medicare Advantage Enrollment Links

Specializing in Medicare and Senior Products

Long Term Care, Annuities, & Life Insurance

Dental & Vision Plans

Address

Golden Years Design Benefits Inc.

55 Schanck Road Suite A-14

Freehold, NJ 07728

Address

Golden Years Design Benefits Inc.

55 Schanck Road Suite A-14