Not appointed with one of the carriers below

Click the button above to request a contract

Medicare

Supplement Tools

To Access, these files Email is – [email protected]

To Access, these files password is: MEDICARE

Click on the file icon to Access Medicare Supplement Underwriting Documents.

Seniors Choice Group Retiree Medical Plans

Merchants Benefit Administration Seniors Choice Admin 18700 N. Hayden Rd, STE 390 Scottsdale, AZ 85255

Online: www.mbaadmin.com Fax: (480) 776-5054

E-Mail: [email protected]

Questions: (480) 776-5040 (toll-free)

2025 Download NJ Horizon Apps

Birthday Rules

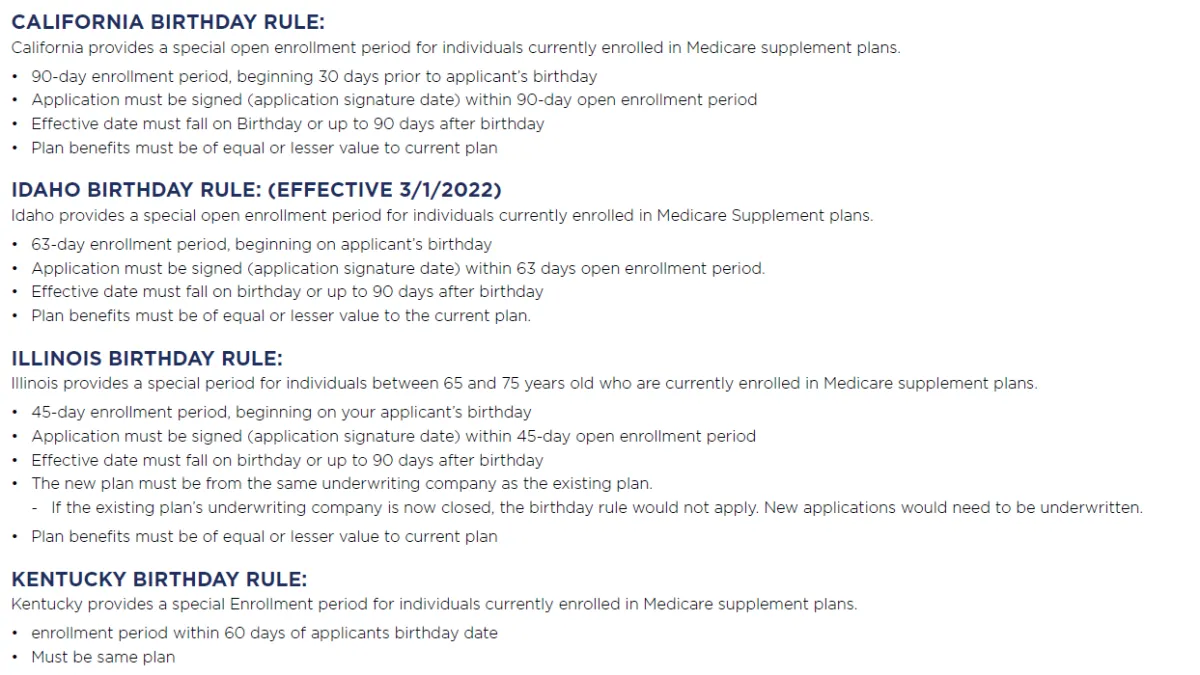

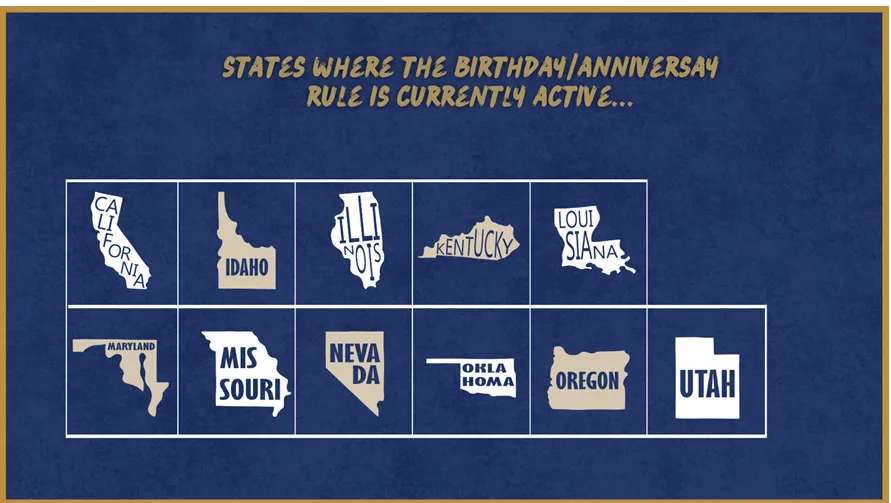

CALIFORNIA BIRTHDAY RULE:

California provides a special open enrollment period for individuals currently enrolled in Medicare supplement plans.

90-day enrollment period, beginning 30 days prior to applicant’s birthday ·

Application must be signed (application signature date) within 90-day open enrollment period ·

Effective date must fall on Birthday or up to 90 days after birthday ·

Plan benefits must be of equal or lesser value to current plan

IDAHO BIRTHDAY RULE:

Idaho provides a special open enrollment period for individuals currently enrolled in Medicare Supplement plans.

63-day enrollment period, beginning on applicant’s birthday ·

Application must be signed (application signature date) within 63 days open enrollment period.

Effective date must fall on birthday or up to 90 days after birthday

Plan benefits must be of equal or lesser value to the current plan.

ILLINOIS BIRTHDAY RULE:

Illinois provides a special period for individuals between 65 and 75 years old who are currently enrolled in Medicare supplement plans.

45-day enrollment period, beginning on your applicant’s birthday ·

Application must be signed (application signature date) within 45-day open enrollment period ·

Effective date must fall on birthday or up to 90 days after birthday

The new plan must be from the same underwriting company as the existing plan.

If the existing plan’s underwriting company is now closed, the birthday rule would not apply.

New applications would need to be underwritten.

Plan benefits must be of equal or lesser value to current plan

KENTUCKY BIRTHDAY RULE (Effective 1/1/24):

Must already have a Medicare Supplement plan.

Must switch to a like plan (example: Plan G to Plan G).

Can apply as early as 30 days before your birthday but no later than 60 days after your birthday.

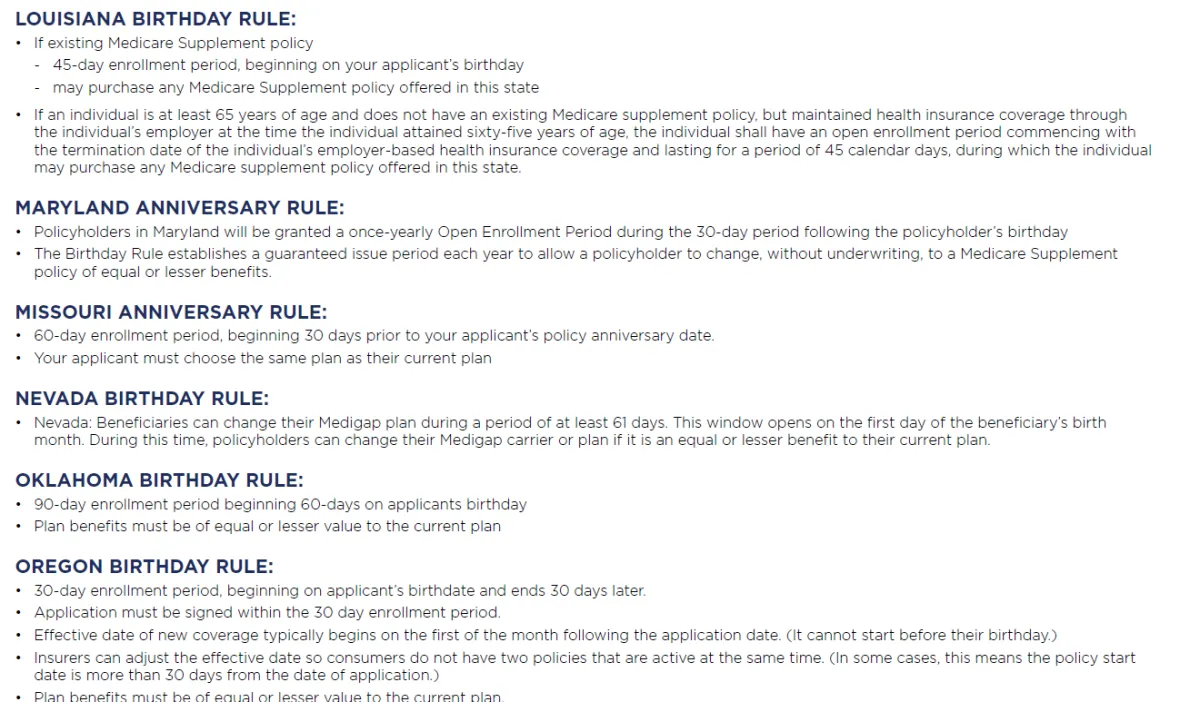

LOUISIANA BIRTHDAY RULE:

If existing Medicare Supplement policy

45-day enrollment period, beginning on your applicant’s birthday

may purchase any Medicare Supplement policy offered in this state

If an individual is at least 65 years of age and does not have an existing Medicare supplement policy, but maintained health insurance coverage through the individual’s employer at the time the individual attained sixty-five years of age, the individual shall have an open enrollment period commencing with the termination date of the individual’s employer-based health insurance coverage and lasting for a period of 45 calendar days, during which the individual may purchase any Medicare supplement policy offered in this state.

MARYLAND ANNIVERSARY RULE:

Policyholders in Maryland will be granted a once-yearly Open Enrollment Period during the 30-day period following the policyholder’s birthday · The Birthday Rule establishes a guaranteed issue period each year to allow a policyholder to change, without underwriting, to a Medicare Supplement policy of equal or lesser benefits.

MISSOURI ANNIVERSARY RULE:

60-day enrollment period, beginning 30 days prior to your applicant’s policy anniversary date.

Your applicant must choose the same plan as their current plan

NEVADA BIRTHDAY RULE:

Nevada: Beneficiaries can change their Medigap plan during a period of at least 61 days.

This window opens on the first day of the beneficiary’s birth month. During this time, policyholders can change their Medigap carrier or plan if it is an equal or lesser benefit to their current plan.

OKLAHOMA BIRTHDAY RULE:

60-day enrollment period beginning on applicants birthday. ·

Individual must be enrolled in a Medicare Supplement plan, with no gap in coverage greater than 90 days since initial enrollment. ·

Plan benefits must be of equal or lesser value to the current plan.

OREGON BIRTHDAY RULE:

30-day enrollment period, beginning on applicant’s birthdate and ends 30 days later.

Application must be signed within the 30 day enrollment period. ·

Effective date of new coverage typically begins on the first of the month following the application date. (It cannot start before their birthday.) · Insurers can adjust the effective date so consumers do not have two policies that are active at the same time. (In some cases, this means the policy start date is more than 30 days from the date of application.)

Plan benefits must be of equal or lesser value to the current plan.

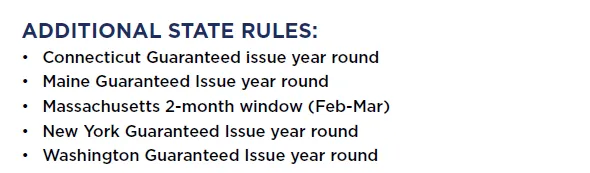

ADDITIONAL STATE RULES:

Connecticut Guaranteed issue year round

Maine Guaranteed Issue year round

Massachusetts 2-month window (Feb-Mar)

New York Guaranteed Issue year round

Washington Guaranteed Issue year round

Frequently asked questions

Can you be denied a Medicare Supplement plan?

If you are in a Medigap enrollment period (6mos of Part B Effective Date) or have the protections of guaranteed issue, your application to enroll in a Medicare Supplement plan can't be denied.

However, outside of these situations, you will have to go through medical underwriting when applying for Medigap, and your application may be denied because of a preexisting health condition, your age or other risk factors.

What's the difference between open enrollment and guaranteed issue?

These two terms are often used interchangeably because guaranteed issue protection (when you can't be denied coverage) happens during open enrollment (the window when you can sign up for plans).

However, the protections of guaranteed issue can also occur outside of open enrollment, allowing you to enroll in a Medigap plan or switch your coverage if you meet the guaranteed issue criteria.

Open enrollment pays a commission while generally gurantee issue does not.

What are the states with the best Medigap guaranteed issue protections?

There are 12 states that provide guaranteed issue protections at least once per year to switch to Medigap or change Medigap plans: California, Connecticut, Idaho, Illinois, Maine, Massachusetts, Missouri, Nevada, New York, Oregon, Rhode Island and Washington.

Medical Questions & Underwriting Guides

Medico

800-748-0026

ACE Medsupp

800-601-3372

Aflac

800-504-0336

Bankers Fidelity

866-458-7501

Cigna MedSupp

877-454-0923

Horizon BCBS of NJ

800-365-2223

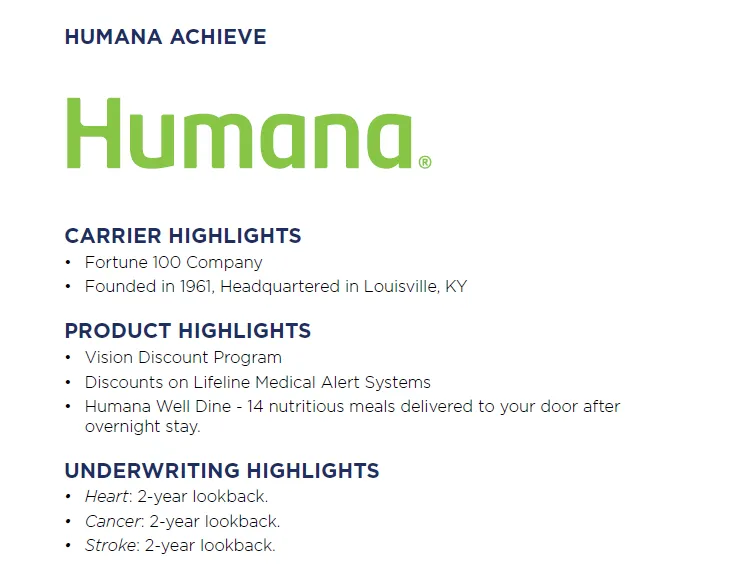

Humana

800-309-3163

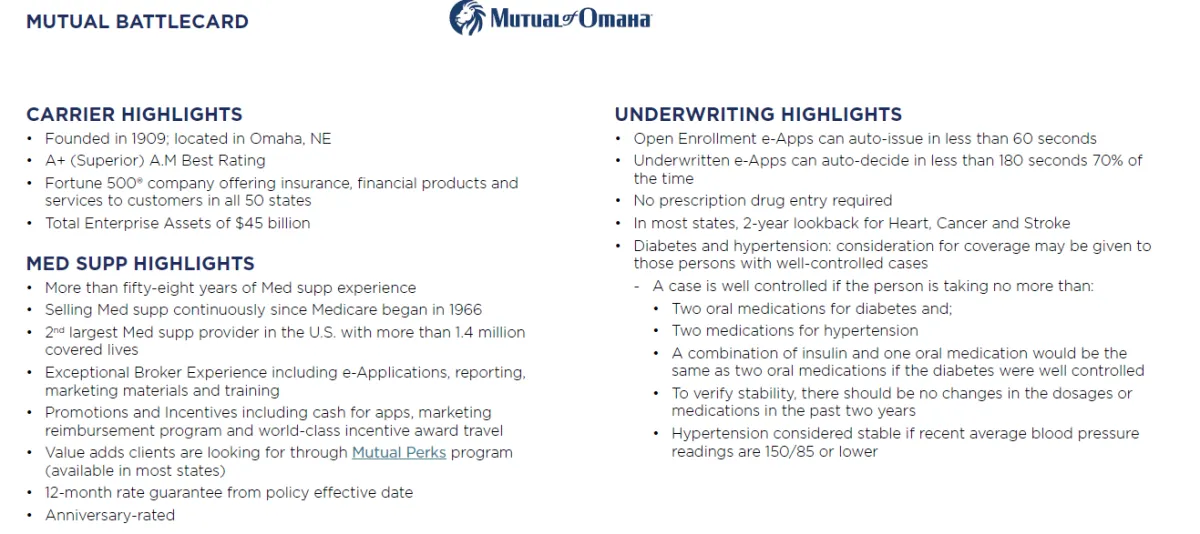

Mutual Of Omaha

800-693-6083

AARP

888-381-8581

AllState Health Solutions

888-966-2345

Aetna Senior Products

866-272-6630

American Benefit Life

1-833-504-0331

Americo

877-212-2346

Anthem

800-633-4368

BCBS of Nebraska

844-201-0763

BCBS of Tennessee

800-565-9140

Blue Shield - California

800-559-5905

Capitol Life

866-237-3010

Central State Health and Life of Omaha

833-522-4874

GPM Life

866-453-4993

Guarantee Trust and Life

800-635-1993

Heartland National

888-996-1619

Liberty Bankers Life

844-770-2400

Manhattan Life

800-877-7703

New Era Life

800-552-7879

Royal Arcanum

888-352- 5158

Sbli | Prosperity eApp

855-321-2755

Sbli | Prosperity agent portal

866-322-2856

Seniors Choice

888-725-3655

Union Security Insurance Company

855-741-4308

United American

800-925-7355

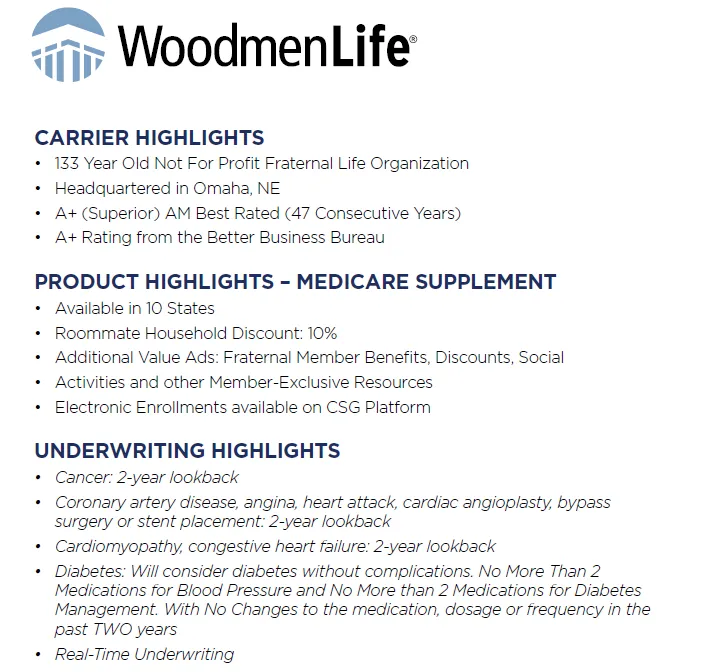

Woodmen Life

1-800-893-6517

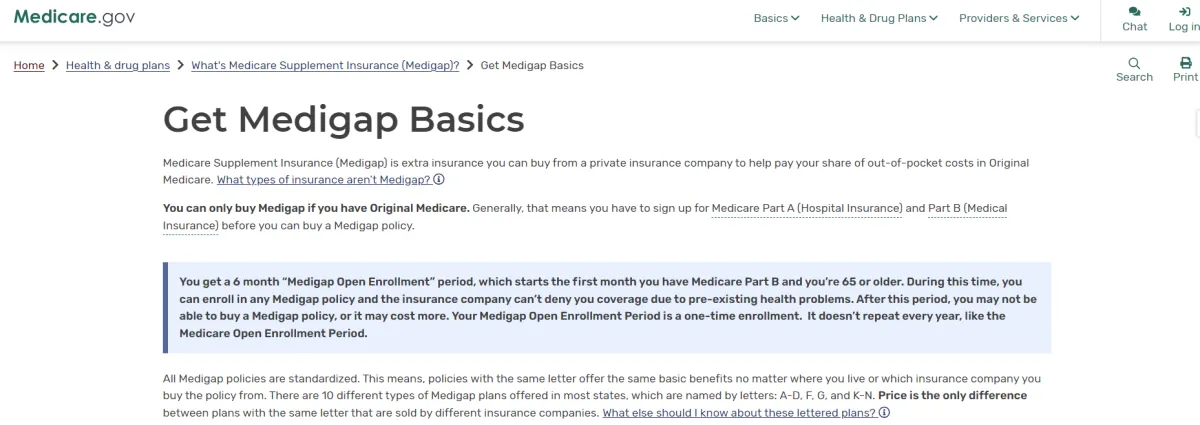

Medigap Open Enrollment:

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. This runs from the date you receive Medicare Part B.

During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have Medicare Part B (Medical Insurance) and you're 65 or older. It can't be changed or repeated.

After this enrollment period, you may not be able to buy a Medigap policy.

After having 6 months of Part B you wll have to qualify and be underwritten to ensure you receive a commission.,

https://www.medicare.gov/supplements-other-insurance/when-can-i-buy-medigap

Guaranteed Issue Rights (Also Called "Medigap Protections")

Typically most insurance carriers do knot pay us a commission if you enroll a client Guarantee Issue Rights.

https://www.medicare.gov/supplements-other-insurance/when-can-i-buy-medigap/guaranteed-issue-rights

are rights you have in certain situations when insurance companies must offer you certain Medigap policies. In these situations, an insurance company:

Must sell you a Medigap policy Must cover all your pre-existing health conditions Can't charge you more for a Medigap policy because of past or present health problems

In most cases, you have a guaranteed issue right when you have other health coverage that changes in some way, like when you lose the other health coverage. In other cases, you have a "trial right" to try a Medicare Advantage Plan (Part C) and still buy a Medigap policy if you change your mind.

You have a guaranteed issue right (which means an insurance company can’t refuse to sell you a Medigap policy) in these situations:

You’re in a Medicare Advantage Plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area.

You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending.

You have Original Medicare and a Medicare SELECT policy. You move out of the Medicare SELECT policy's service area.

You joined a Medicare Advantage Plan or Program of All-inclusive Care for the Elderly (PACE) when you were first eligible for Medicare Part A at 65, and within the first year of joining, you decide you want to switch to Original Medicare. (Trial Right)

You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back. (Trial Right) Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own.

You leave a Medicare Advantage Plan or drop a Medigap policy because the company hasn't followed the rules, or it misled you.

Note

There may be times when more than one of the situations above applies to you. When this happens, you can choose the guaranteed issue right that gives you the best choice.

Access DropBox for Med Supp Underwriting Documents

Email: [email protected]

Password is: MEDICARE

Click on the file icon to Access Medicare Supplement Underwriting Documents.

Sign Your Client up for an AARP membership

Medicare Advantage Enrollment Links

Specializing in Medicare and Senior Products

Long Term Care, Annuities, & Life Insurance

Dental & Vision Plans

Address

Golden Years Design Benefits Inc.

55 Schanck Road Suite A-14

Freehold, NJ 07728

Specializing in Medicare and Senior Products

Long Term Care, Annuities, & Life Insurance

Dental & Vision Plans

Address

Golden Years Design Benefits Inc.

55 Schanck Road Suite A-14